You get your payslip – and your eyes go straight to the bottom right-hand corner. How much did you get! And fair enough too – but just what do all those other parts mean?

.png) Section 1

Section 1

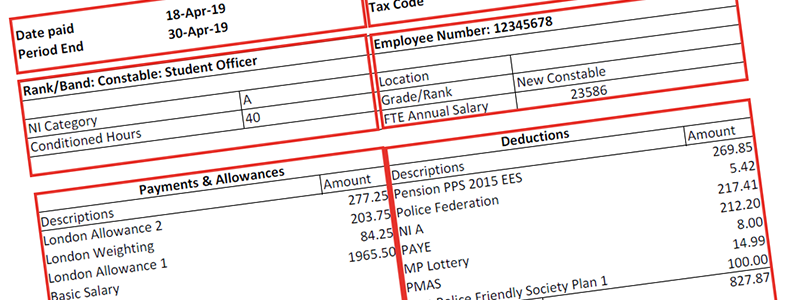

So, once you know how much you’re due to get, cast your eye back up to the top of the payslip to find out when you’ll receive it.

Usually you will receive your pay on the 20th of the given month (a bank holiday like at Easter might bring the date forward), with the payment being in respect to the full month ending 30 April, i.e. the period end.

Section 2

At the top right is your National Insurance number. This is always two letters, six numbers and then a letter.

Below is your tax code. This code represents the current personal allowance which the majority of you will have. So as an example, 1250L means that the first £12,500 of your income will be free from tax.

A “cumulative” tax code means that the amount of tax you pay each month takes account of the salary you’ve already received and the total tax you’ve paid in the current year to date – not just the current month. Therefore, any changes during the year are automatically accounted for and at the end of the year you should have paid the correct amount of tax.

Section 3

Section 3

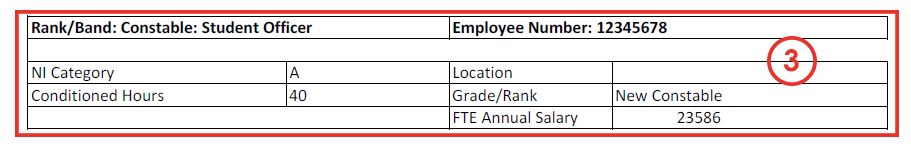

The top line of this section is information about you, showing your rank or band and your employee number.

Below is your NI Category – this is NOT the same as the letter at the end of your national insurance number. The NI category is different and will normally be “A” which indicates you are paying full NI contributions. “A” also implies you are under State Pension Age but over 21. If your letter is any different, you should check it on HMRC’s website.

For full-time officers, the conditioned hours will usually be 40. However, if you are working part-time, for example if you’ve returned from maternity or on recoup duties as part of a managed return to work, you should note the number of hours recorded here.

Location is wherever you’re based and Grade/Rank reflects your current rate of pay.

FTE stands for Full Time Equivalent, and your Annual Salary is as it says.

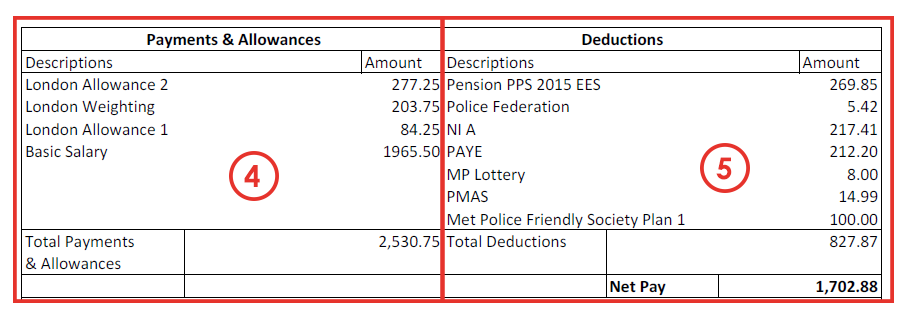

Section 4

Section 4

This section of the payslip deals with your earnings. There are a few things that can be listed under Payments & Allowances, but the ones shown in this example are the most common.

London Weighting and the London Allowance (1 and 2) are set amounts and are the same for all federated ranks regardless of service.

Any unsocial hours payments and overtime will also be listed here together with the rate at which it’s calculated. Basic salary is as it sounds – your yearly salary divided by 12 to give a monthly amount. The total at the bottom is your gross income (which means before any deductions are made) for that month.

Only two of these things are pensionable, your basic salary and London Weighting.

If you received Statutory Sick Pay, that would be shown here also, offset against the amount you would have received had you been working.

Section 5

This part of the payslip deals with the deductions that are made from your gross pay, leaving you with what you will get in your pocket that month – your Net Pay!

Pension PPS 2015 EES is your pension contribution, which equates to 12.44% of pensionable pay in this example. But within your scheme (the 2015 Care Scheme in this example) pension contribution rates can vary depending on your pensionable pay:

- Tier 1 – up to £27,000 a year: 12.44%

- Tier 2 – between £27,000 and £60,000: 13.44%

- Tier 3 – over £60,000 a year: 13.78%

Police Federation refers to your Police Federation subscriptions. These are taxed at source to save you the effort of having to claim them back.

NI A is your National Insurance contribution. For the vast majority of you, this is 12% of your earnings over £166 per week but can depend on your individual circumstances.

PAYE (Pay As You Earn) is your Income tax. This is what you pay the tax man. For the majority of you the rate will be 20% of all taxable income over £12,640 until April 2020. Why £12,640? In the last Budget, the personal allowance went up to £12,500 for most adults. However as Metropolitan Police officers, you also automatically receive an extra allowance of £140 per year as your “Uniform Tax Allowance”; we cover that again later.

If you take part in the MP Lottery, this is where your payment will appear. As the saying goes, “you’ve got to be in it to win it”!

Any Metfriendly savings plans or protection policies that are paid for by salary deduction are included here and will show as Met Police Friendly Society or MPFS.

Some of the other common deductions that might show up here include:

Group Insurance – these are your life cover benefits and more, if you have chosen to pay for them through the Federation’s Group Insurance Scheme (GIS). If you have not done so already, we recommend that you check their website for details of all the benefits available. It can provide £150,000 cover, plus a lot of other extras for just £11 a month. Do note that Off Duty cover is only available through the most recent version of the GIS.

Travel Insurance – Another option that you can choose to pay for through the Federation. Again, contact them if interested. Their policy costs £4.95 per month and includes repatriation.

Reg 28 Insurance is protection available through the Federation again, that covers you in the event of you ending up on half pay or no pay due to sickness or injury.

ATOC is a concession that will only apply to officers who joined before 31st December 2013. It pays for your travel on tubes, trains and buses. Make sure if you travel outside London that you are still within the ticket-free travel area. If part of your journey is outside then you must buy a ticket for that part. From 2014 officers receive a TFL concession which gives free travel on tubes and buses only.

GAYE stands for ‘Give As You Earn’. You can choose to donate to the Metropolitan Police Benevolent Fund which provides funding for the Rehabilitation Centre at Flint House in Goring, the Metropolitan and City Police Orphans Fund and the Relief Board. The donation comes out directly from your salary and is shown here. It’s a nice way to be able to donate regularly to a cause close to your heart and on a tax-free basis.

TAUA stands for tax adjustment uniform allowance. This is paid to you in April, even though it appears on the Deduction side. It’s the allowance for uniform cleaning that you would otherwise have to claim individually from HMRC.

Overpayment Non-Tax Taxable Recovery – if you ever see this, this will be in relation to a sum that you’ve agreed to pay back because of previously being overpaid.

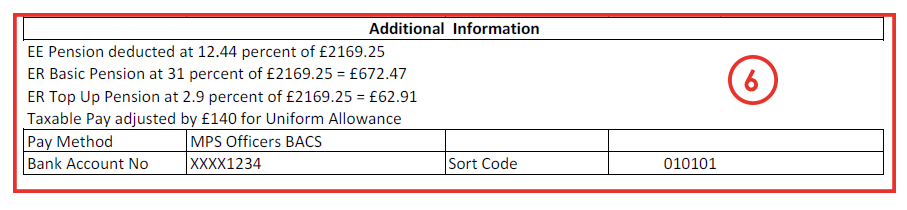

Section 6

Section 6

If you’ve worked any overtime or unsociable hours, this section will split those payments out into the various rates and number of hours at each rate. It’s a good idea to keep a record yourself of the additional hours you worked so that you can check you’ve been paid correctly.

It also shows the percentage of Pension deduction for you – the employee (EE), the percentage paid by the MPS – your employer (ER), and the amount of pensionable pay it is based on. Remember that pensionable pay is basic salary and London Weighting only.

You’ll see there may be a note regarding Tax Adjustment Uniform Allowance (TAUA – your uniform cleaning allowance, as mentioned earlier). This is £140 and is applied once a year generally in April. The TAUA is automatically applied and has already been added to your personal allowance.

Below that you can see confirmation of the method by which you get paid – this will generally be BACS (Bankers Automated Clearing Services) and details of the account that your money is being paid into.

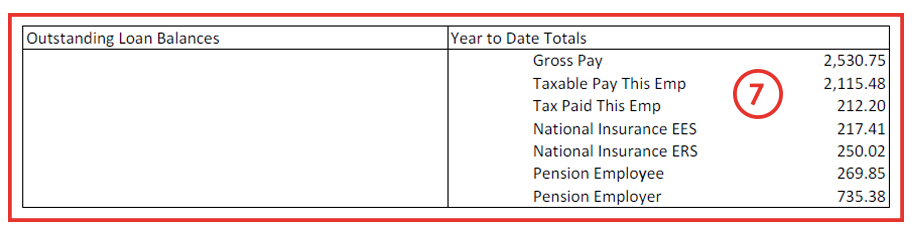

Section 7

Section 7

The Outstanding Loan Balances section will show any loans that you may have taken from the MPS for instance if you’re a student who completed their CKP before joining.

On the right-hand side are your Year to Date Totals, which over the year will accumulate and show you a summary of how much you’ve been paid, how much tax and National Insurance has been paid, and contributions into your pension.

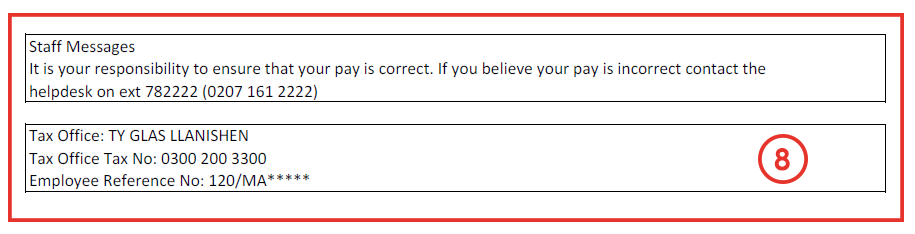

Section 8

Section 8

You’re advised to look at this section for any important staff messages. For any issues with your Pay Advice slip, you can contact the Pay Branch Help Desk/Equiniti on 0207 161 2222.

The last section gives your Tax Office location, contact number and employers reference in case you ever have to contact the tax office.

Now you know your Net Pay, you can get to work on making sure you know where your money goes every month. Our budget planner will help you to breakdown your areas of expenditure and once you have done this, you can start identifying any areas to make savings. This is the first step on the road to financial success for you and your family.

To find out more about our savings plans or protection policies and how to pay by salary deduction, call us on 01689 891454 or email us at [email protected].

Share