When looking at where to invest your savings, it’s important to understand how rates are advertised and what you’ll get back for your money.

If you’re looking for somewhere to invest your savings with a guaranteed interest rate, our Guaranteed Five Year Fixed Rate Bond is extremely competitive.

As at 22nd March 2024, our interest rate of 5.125% gross* for five years will pay you 4.1% net of basic rate tax. That’s a massive 22.25% return over five years – guaranteed!

If you’re considering your options, it’s worth remembering a few things. Here are some pointers:

1. Always read the small print

Some companies mention the gross rate or net rate whilst others highlight the Annual Equivalent Rate (AER) but always be clear on what your return actually is.

Many companies quote rates before tax is taken into consideration – which can severely impact your return. Our Guaranteed Five Year Fixed Rate Bond will pay you 4.1% annual interest net of basic rate tax, which amounts to a 22.25% return.

2. Premium Bonds

Whilst Premium Bonds quote 4.4% variable as an average rate of return, as Martin Lewis puts it, it’s a ‘vague watermark’ suggesting for every £100 paid in, £4.40 is paid out. But as the smallest prize is £25, this is impossible.

If you bought £10,000 in Premium Bonds with average luck and as a basic-rate taxpayer, the anticipated return (using Martin Lewis’ calculator) is £375. This, of course, is not guaranteed – especially if you are unlucky!

3. Be aware of the Personal Savings Allowance

There are some decent interest rates around for your savings, but be mindful of your Personal Savings Allowance (PSA). In the UK, you can currently earn up to £1,000 in interest without paying tax, £500 if you are a higher rate taxpayer.

If you hold more than £10,000 in savings and you are a higher-rate taxpayer, any rate over 5% will subject your hard-earned savings to income tax. Any returns from the Guaranteed Five Year Fixed Rate Bond fall outside the PSA, which means there is no additional tax to pay.

4. Be aware of falling interest rates

Reports in the news quote the Bank of England boss as saying “we are on the way” to interest rate cuts after they were left unchanged at 5.25%, their highest for 16 years.

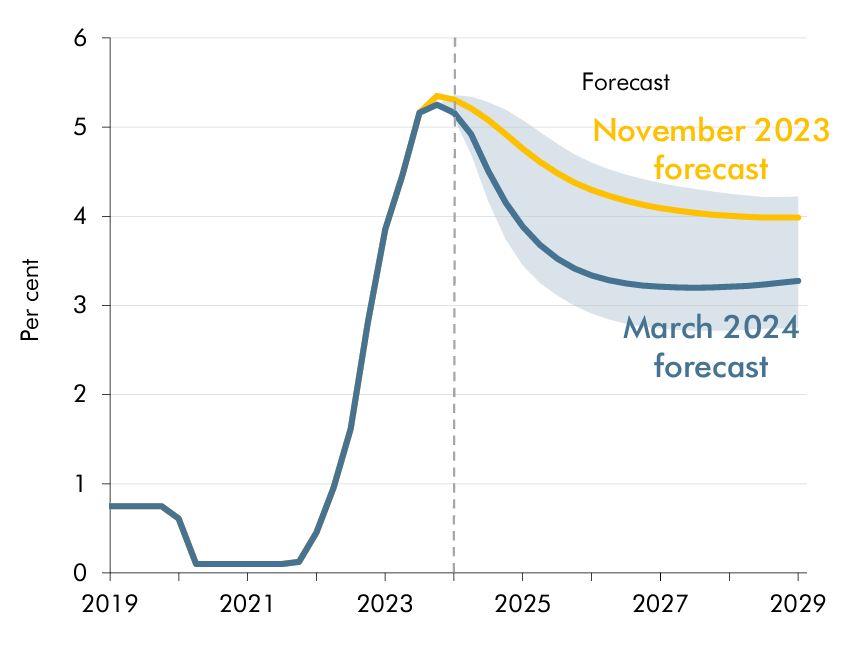

As at March 2024, the Office for Budget Responsibility (OBR) forecast bank interest rates will drop rapidly, reaching under 3.5% before the end of 2025. This is great news for mortgage holders, but not so good for savers. Today’s higher interest bank rates won’t be around forever. Next year, they are forecast to be significantly below our guaranteed bond rate.

Bank interest rates (source: OBR March 2024 Economic and fiscal outlook)

Why invest in a Metfriendly Savings Plan now?

Metfriendly is 100% Police Family focused and owned by its members.

- We were established in 1893 by serving Officers to look after the Police Family

- As a mutual, we are owned by our Police Family members – no money needs to be paid out to shareholders

- Our products are 100% protected by the Financial Services Compensation Scheme (FSCS) for insurance products, so there is no upper limit on the amount protected

- Serving, former and retired UK Police, and their family members can all save with Metfriendly

Find out more about our Guaranteed Five Year Fixed Rate Bond and don’t miss your chance to secure an extremely competitive fixed rate of interest for your savings.

Need help deciding? Speak to us today

If you need any help understanding your saving options, we’re on hand to help. Call our friendly team on 01689 891454. Our office hours are 08:30 to 17:00 Monday to Thursday and 08:30 to 16:30 on Friday.

If you’re not available during our office hours, send us your contact details and we’ll call you back at a time to suit you.

* Gross interest figure based upon internal Metfriendly calculation for information only – please check your understanding with your own tax adviser.