As we have witnessed significant volatility in stock markets around the world linked to events in Ukraine we have been looking at ways to help our Members understand the impact of such financial movements on their Metfriendly investments.

As at the 8th March 2022, the UK stock market had fallen by almost 6% since the start of the year. Over the same period the Metfriendly With-Profits fund had fallen by only 4%.

During these times of market volatility, it is important to take a step back and consider the full picture. And as the markets continue to move, we will provide you with regular performance updates.

Balancing safety and returns

So, what does this mean for Members who are invested in the Metfriendly With-Profits Fund? To quote Money Savings Expert, Martin Lewis[1]: “There are only two prices that count the price you buy at and the price you sell at”.

What this means is that when markets are down, it only really matters to those that need to cash in their policies earlier than expected. This means that most Members who have held a policy with Metfriendly for many years, will see very little change in the value of their ISA, With-Profit Bond or savings plan.

“There are only two prices that count the price you buy at and the price you sell at” – Martin Lewis

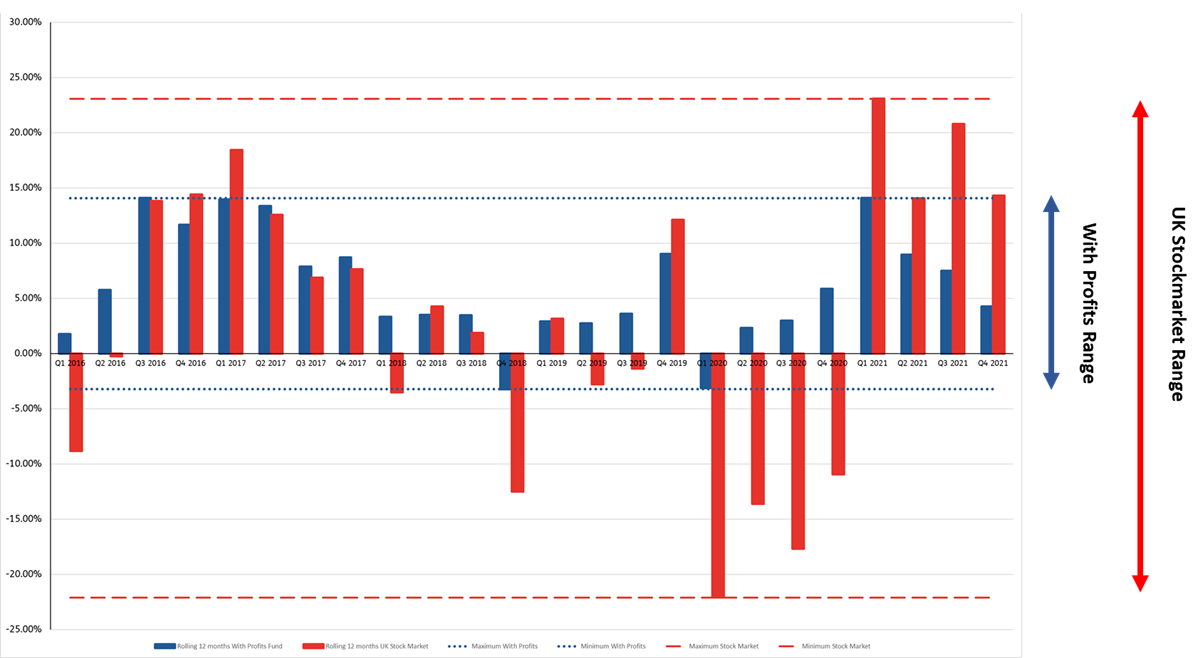

This is illustrated in the graph below, which shows the rolling 12-month performance over the last 5 years for the UK stock market[2] and the Metfriendly With-Profits fund. The Metfriendly With-Profits fund has had a less bumpy ride than the UK stock market due to our investment in a diversified portfolio of assets. This is how we balance safety and returns on Members’ money.

With-Profit Fund Performance vs UK Stock Market 2016 to 2021

Despite the market volatility witnessed so far in 2022, our financial strength continues to be strong and has remained comfortably within the Society’s risk appetite target range. Our own funds, which are the assets we hold in addition to those required to cover liabilities to Members, are estimated to cover our Solvency Capital Requirement by nearly double.

Unlimited protection for your savings

Remember also that Members’ policies have the safety net of the Financial Services Compensation Scheme (FSCS) for insurance policies to fall back on. This means that there is no upper limit on the amount protected, unlike the FSCS Deposit and Investment schemes which are limited to £85,000 per person per company. This also means it could be a smart decision for Members to bring investments together with Metfriendly as decluttering finances will make it easier to get a clear view of their savings and investments.

Finally, the new tax year will start on 6th April, so your annual ISA allowance will be refreshed allowing you to save up to £20,000 per year tax-free.

Visit our website to find out more about investing a lump sum or topping up your Metfriendly ISA. There’s also information on how to transfer an existing ISA to Metfriendly.

To speak to someone about our products and savings plans, call us on 01689 891454 or leave your details here and we’ll give you a call back.

[1] The Martin Lewis Money Show – A Coronavirus Special Episode 1, 19th March 2020, 8.30pm, ITV

[2] The UK Stock Market performance is based on the top 100 UK companies measured by market capitalisation

Share