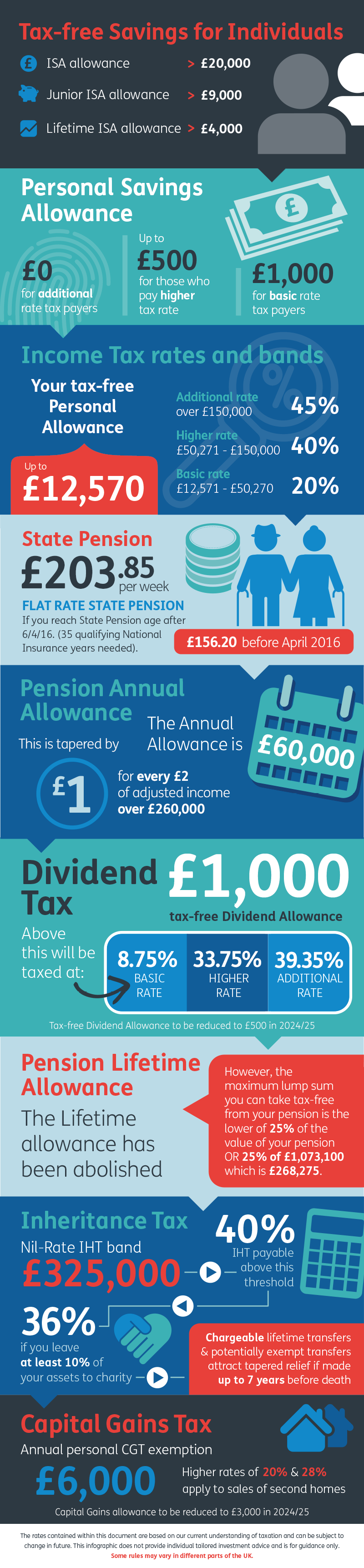

Check your annual tax allowances, including ISA savings limits with our handy infographic.

Every tax year anyone over 16 and a UK resident can save into an Individual Savings Account (ISA) which means that you can save without having to pay UK income tax or capital gains tax on the returns.

At the beginning of every new tax year your annual ISA allowance resets. In the 2023/24 tax year, the maximum you can save in ISAs is £20,000. You can’t carry over your allowance to next year, so if you don’t use it you lose it.

The infographic below illustrates the tax thresholds for the tax year ending 5 April 2024:

Make the most of your allowance this year. You can split your allowance any way you like across a Stocks and Shares ISA, Cash ISA, and a Lifetime ISA (maximum of £4,000) as long as you stay within the £20,000 overall limit. So for example you could put £4,000 into a Cash ISA, £4,000 into a Lifetime ISA and the remaining £12,000 in a Stocks and Shares ISA.

The allowance for Junior ISAs is less. The limit this tax year is £9,000. Metfriendly offers a Junior ISA that gives you the option of either committing to regular monthly contributions or investing a lump sum, or a combination of both.

Share